As of June of 2023, real estate market activity in Atlanta shows steady price appreciation, along with an increase in housing inventory.

In other words, sellers can look to make a profit, while buyers will not find themselves short of choices.

Those thinking of buying a home in Atlanta will have a lot of room to work with when it comes to deciding on one of their most important investments. They can also anticipate a lot of rewards when they decide to resell.

Thus, buyers will need to do their homework and know what to do before they make the purchase.

Table of Content

-

DETERMINE A BUDGET

Market data as of June 2023 shows that the median price for a home in Atlanta is $439,000 – a 5.8% increase compared to the median price at the same time last year. Some homes cost far more than this figure, though, while there are options at slightly lower price points.

The key to finding that sweet spot that determines which home to purchase is setting a budget. Here are some tips to consider:

-

Assess one’s financial situation

First off, it’s important to determine what the homebuyer can and cannot afford. Setting realistic goals will help make sure that no overspending happens, and the buyer won’t go through financial difficulties.

The homebuyer should plot how much they spend on these essentials monthly and deduct them from how much they will be able to save toward his downpayment, as well as their mortgage:

- Credit card debt

- Healthcare insurance

- Car insurance

- Groceries

- Car payment

- Utilities

- Subscriptions

-

Check how much downpayment is needed

Homebuyers should keep in mind the amount that they are expected to spend varies from case to case. They can check the status of the real estate market in Atlanta here and tailor their home buying accordingly.

-

Check closing costs

Buyers also need to pay closing costs, which are the expenses incurred during the process of buying a home. These include appraisal fees, mortgage underwriting fees, insurance, and real estate commissions.

This will also vary from case to case, and even from area to area. In Georgia, the average closing costs range from 3% to 4% of the loan amount. Some sellers may offer to settle the closing costs instead, as part of seller concessions.

-

Check potential maintenance costs

Potential preventive and reactive maintenance is another area to consider. This will depend on several factors, such as:

- The state of the property upon purchase

- The specific amenities of the property (whether it’s a smart home, etc.)

- The specific services owner needs to budget for, like lawn care, pool maintenance, etc.

- The size of the home

-

Explore financing options

Finally, homebuyers should assess their mortgage options. There are several types of loans that buyers can use:

- Fixed rate mortgages. These mortgages come with fixed monthly payments. They are often typically stricter than other types of loans, but the payoff is that the borrower knows exactly how much they will pay each month for the duration of the loan, regardless of external factors that may negatively affect the interest rate.

- Adjustable rate mortgages. Adjustable rate mortgages are a better option for those who have less financial leverage to work with in the beginning. These loans have low introductory rates that gradually increase over time. As such, they’re perfect for those who can expect salary raises or an increase in business profit in the near future.

- Government-backed loans. Buyers can also opt for one of the available government-backed loans, which are loans that feature the U.S. government as a guarantor. These loans also target those with lower income, or those who fit certain eligibility requirements (like members of the US military). Examples include:

- FHA loans

- USDA loans

- VA loans

-

-

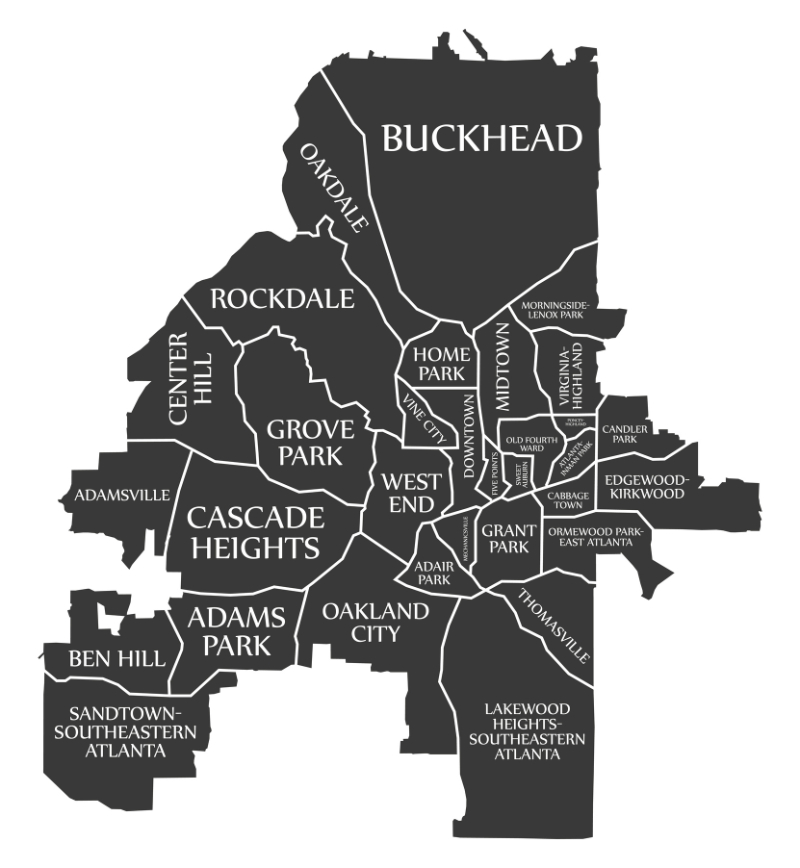

RESEARCH ATLANTA’S NEIGHBORHOODS

Atlanta is known to attract a lot of young people who want round-the-clock entertainment. However, the city is also great for those looking to settle down and grow their family. Whether a buyer is looking for a home right within the city or in one of its suburbs, they have a lot of amazing neighborhoods to choose from, both in Intown Atlanta and Buckhead.

Sandy Springs

Offering residents a blend of city living with subtle rural charms, Sandy Springs is known for a variety of attractions that can cater to those who love the outdoors and those who like indoor activities. As such, it is no surprise that it features some top-rated schools, healthcare facilities, family-friendly activities, and retail and dining options.

For instance, those who want their children to attend above-average public schools can choose from Denmark High School, Atlanta Classical Academy, and the International School of Atlanta. Additionally, the neighborhood is included in the top 30 list of Niche.com’s Best Places in the following categories:

- 13th Healthiest City in America

- 18th Best City to Live in America

- 20th Best City for Young Professionals in America

- 20th Best City to Retire in America

- 24th Best City to Raise a Family in America

Browse homes for sale in Sandy Springs

Tuxedo Park

Tuxedo Park boasts a rich heritage as one of the most exclusive neighborhoods in Atlanta. So those who are looking for luxury homes for sale in Atlanta, GA will find several magnificent estates lining Paces Ferry and beyond.

Most of the residents in the area own their homes. The majority of the population also has a bachelor’s or advanced degree. Additionally, compared to other places, it is relatively secure.

Contact Annette Izquierdo of HOME Real Estate for listings in this neighborhoodCollier Hills

For families that are looking to incorporate a lot of fun activities into their weekends, Collier Hills is a treasure trove of local parks, playgrounds, and recreation areas. For starters, it houses Tanyard Creek Park, which is a 14.5-acre park with lots of open fields and woods for all-day explorations.

The majority of the residents in this neighborhood are also well-educated. Homes sell for a little under $1 million, on average.

Contact Annette Izquierdo of HOME Real Estate for listings in this neighborhoodHistoric Brookhaven

Another great destination for those looking for upscale houses for sale in Atlanta, Georgia, Historic Brookhaven has maintained its reputation as an exclusive sanctuary that treats residents to a mix of elegance and modern convenience with its ideal location.

It features the Capital City Club, the oldest members-only club in the city of which nearly half of the residents in the neighborhood are members. Its surrounding estates have also been added to the National Register for Historic Places, while also within reach of premier amenities such as shopping malls and restaurants.

On top of these, buyers can also look at Ardmore Park, which makes up part of Intown Atlanta’s most diverse neighborhoods. There’s also Haynes Manor, with homes that run adjacent to Peachtree Road’s range of shops and restaurants for convenience.

No matter which neighborhood a buyer chooses, buying a home in Atlanta will be a rewarding decision. However, to make the most of these rewards, one needs to determine their needs and wants first.

-

IDENTIFY NEEDS AND WANTS

Central to finding the best home for sale in Atlanta, Georgia is determining the specific features, price range, home type, and other factors that the homebuyer needs and wants.

To figure this out, the buyer must remember these tips:

-

Make a list of must-have features and amenities for the ideal home

It’s important for the buyer to start the pre-shopping process with a defined list of the features and amenities they desire. This will help ensure that the buyer will enjoy the home to the fullest, as well as make it appealing to future buyers if they plan to resell it down the road.

Some of the most ideal features and amenities to consider are those with smart home functionalities, which can radically improve the home’s comfort, convenience, and safety. Additionally, these features can help recoup about 50% of the investment. Voice-enabled technologies, in particular, are highly sought-after.

Hardwood flooring is another great option, as are long or parallel kitchen islands. These will not only improve the aesthetics of a home, they will also make it more functional, especially for entertaining guests.

Another benefit of knowing exactly what a buyer wants is that they will be able to have clarity, if comparing options.

This is particularly important when faced with several homes for sale with similar features. Knowing what to look for will allow the buyer or agent to eliminate those that tick off very few boxes on the wishlist.

-

Prioritize all requirements and consider future needs

If a buyer can’t quite find something that meets all their must-haves because of budget constraints, the next best thing to do is to prioritize the most important requirements that meet both current and future needs.

For instance, if the homebuyer wants utmost comfort for their growing family but can’t splurge on a sprawling estate, they can opt for homes with open floor plans. These will help maximize the available space in the home and allow buyers to reconfigure the layout accordingly.

-

Determine the desired home type

Finally, it’s essential to decide on the specific type of home to purchase. There are a lot of options to choose from when it comes to available houses for sale in Atlanta, Georgia, such as single-family homes, condos, or townhouses.

These types come with differing price ranges, as well as maintenance requirements. So when choosing, the buyer needs to be clear about what they can and cannot afford, so that they can make the most of his budget.

Unless paying in cash, a buyer’s best way to determine how much house they can afford is to get pre-approved for a mortgage. Based on the buyer’s financial documents and credit score, the lender will indicate the amount the buyer can expect to get on their loan application. Thus, the buyer saves time by searching for homes within the prescribed amount.

-

-

START HOUSE HUNTING

Here’s how homebuyers can house hunt for the best mid-tier and luxury homes for sale in Atlanta, GA.

-

Try out different strategies for finding suitable properties in Atlanta

There are various ways to look for the best home for sale in Atlanta, Georgia. Trying all these out can help widen the scope of a homebuyer’s search and give them more options to work with. These strategies include:

- Online listings. Real estate listing websites, real estate groups on Facebook, etc.

- Open houses. Google, multiple listing services, social media platforms, local newspapers, etc.

- Off-market options. Real estate agents

-

Organize and keep track of potential homes

Monitoring and revisiting homes will allow the homebuyer to hone in on the best possible option for their budget. Here are tips on how to do that:

- Document homes they like and their reasons, such as location, price, features, amenities, size, etc.

- Take photos of the properties they visit in person for visual comparisons

- Bookmark or save homes on listing websites

-

Make an offer

Once a decision is made, the next step is to make an offer. Here are recommendations on how to go about the process:

- Consult your real estate agent. They will be in the best position to gauge the situation in terms of current market conditions, the price of comparable homes for sale in the neighborhood, the motivations of the seller, and other factors borne out of their expertise. Their analysis and recommendations will allow you to make a fair and competitive offer.

- Show proof of financial capacity. The homebuyer should be ready to show their mortgage pre-approval letter, should the seller or their agent request it. It proves that the buyer has the financial wherewithal to buy the house.

- Decide on the offer and the earnest money deposit. Most homes for sale in Atlanta sell at or above the market listing price. So when making an offer in a seller’s market, the amount the buyer is willing to pay should ideally be close to the listing price of the property. Additionally, he should be ready to pay 1% to 2% of the total listing price as an earnest money offer. This will be held in an escrow account and applied to the mortgage down payment later on.

- Define contingencies. Home contingencies will allow a buyer to walk away from the sales process with his earnest money intact, in case they’re not met by the seller. At the same time, they’re a great negotiation tool so the buyer can ask for a price markdown if they agree to have them waived. Common types include home inspections, appraisals, and financing.

- Write the offer letter. Finally, the buyer should draft an offer letter and send it to the property seller. The offer letter should include:

- The home’s address

- The name/s that should reflect on the house title

- The offer price

- The earnest money deposit

- Contingencies required and/or waived

- The buyer’s mortgage approval letter

- Accessories requested to be included in the sale, like appliances

- Planned move-in date

- Deadline for the seller’s response to the offeR

The real estate agent can lend a hand in case the buyer doesn’t want to go through the trouble of writing the offer letter.

-

-

WORK WITH A REAL ESTATE AGENT YOU CAN TRUST

It’s important for buyers to work with a real estate agent who will champion their cause and make sure that:

The buyer can negotiate the terms of the sale to their advantage

It’s always wise to work with a real estate agent. They’ll always put their clients first and make sure their buyers get the best deal possible.

Buying a home without the help of a real estate professional puts the buyer at risk of bowing to the demands of the seller because of a beginner’s inability to recognize areas that are open to negotiation.

For instance, a real estate agent can advise their client to waive certain contingencies in lieu of offering an amount higher than the list price, among other things. Additionally, a real estate agent allows the buyer to understand specific market conditions that make certain concessions agreeable to the buyer. If the house has been listed for a long time, for example, the seller might agree to lower the price or let the buyer give a lower earnest money deposit.

The buyer can ensure the efficiency and legality of the process

Another important advantage of working with a real estate agent is that the technicalities of the process can be delegated to them. In this way, the buyer can be certain that the sale will start and end successfully, and according to the rules and regulations that govern the transaction.

The buyer can enjoy their investment

Finally, the homebuyer can look forward to making the best possible investment. An experienced real estate agent can go through the tricky process of negotiating the finer points of the transaction upon the buyer’s behest.

A reliable company like HOME Real Estate specializes in streamlining the search process for buyers in Atlanta, GA so that they will find the best possible option for their budget, requirements, and future plans.

With extensive experience in Atlanta’s luxury real estate market, HOME Real Estate holds specific industry knowledge to help buyers successfully buy their dream home.

The company also leverages best-of-industry practices to bring buyers the best homes on the market. Their strategies are grounded in ethical practices so clients can be sure that their investment is safe and covered.

Get to know more about HOME Real Estate or contact HOME real estate agents by calling 404.538.1491 or sending her an email.